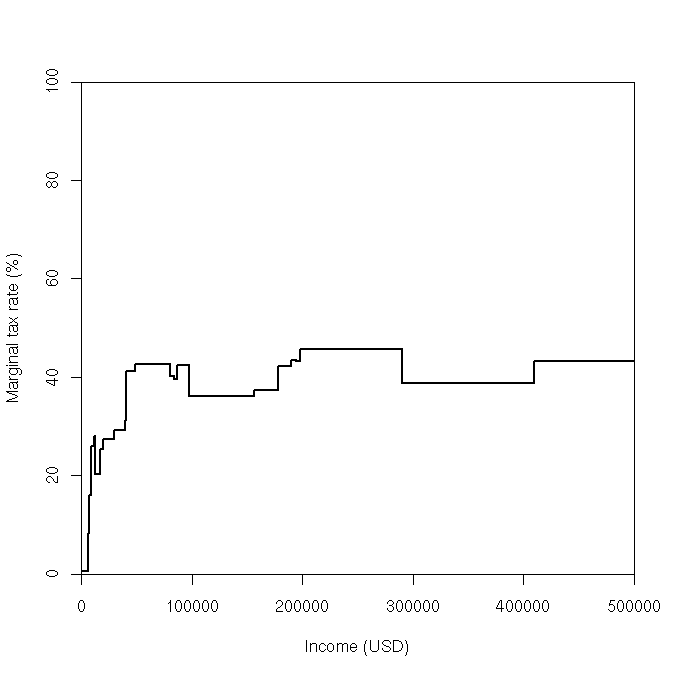

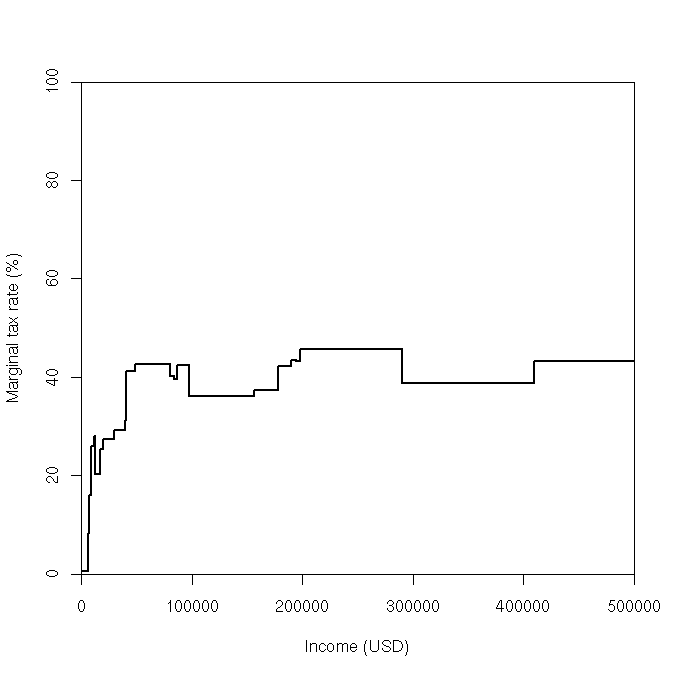

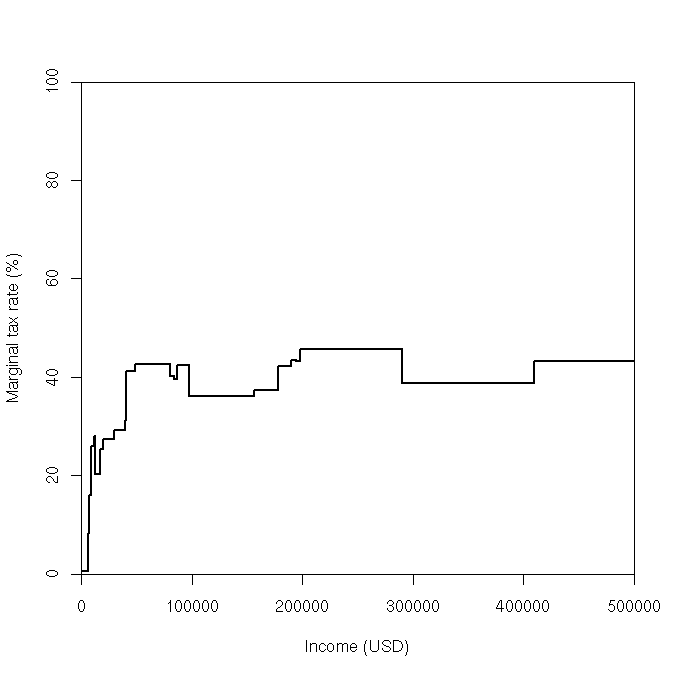

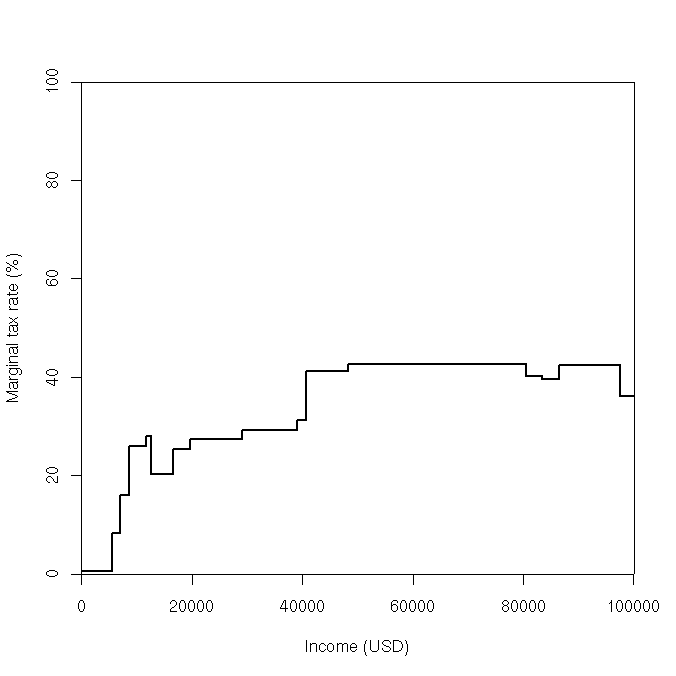

Marginal income tax rates for a single California resident with only wage income, 2007

As I did some taxes this year (March 2008), going through some of the

forms (by hand, as I always do, partly since I like to understand what

it is that I'm paying) made me realize how bizarre our tax system

is.

Consider the following relatively simple example: a single

(non-dependent) person in California earning all of their income from

wages, salaries, and tips. (Once antipoverty programs like the Earned

Income Credit aren't relevant, this assumption could be relaxed to allow

income from many other sources as well, although capital gains are taxed

differently.) Assume further that this person's withholding is perfect

so that they can deduct exactly their 2007 state taxes from their

federal returns once they get to the point of itemizing deductions

(rather than having some variation from year to year due to imperfect

withholding). Consider the effect of the following taxes:

- US Income Tax

- progressive

rate with some initial income excluded due to subtracting standard

deduction and exemption amounts, with deductions itemized once it

becomes worth itemizing deductions (rather than taking the standard

deduction) based on state taxes paid alone (see two California taxes

below)

- Social Security Tax

- 6.2% of income under $97500 (ignoring that it's really

double that because the employer pays the same)

- Medicare Tax

- 1.45% of income (ignoring that it's really

double that because the employer pays the same)

- US Alternative Minimum Tax

- A separate

progressive tax structure that allows fewer deductions, forcing rich

people to give up some of their itemized deductions if this structure

produces a larger tax than the normal tax structure.

- California Income Tax

- progressive

rate with some initial income excluded due to subtracting the

standard deduction and exemption amounts

- California State Unemployment/Disability Insurance

- 0.6% of income under $83388.33

- Earned Income Credit

- A federal antipoverty program that subtracts from income tax

(potentially making it negative). Doesn't pay much to people without

children, so doesn't figure much here.

This yields the marginal rates shown in the following graph:

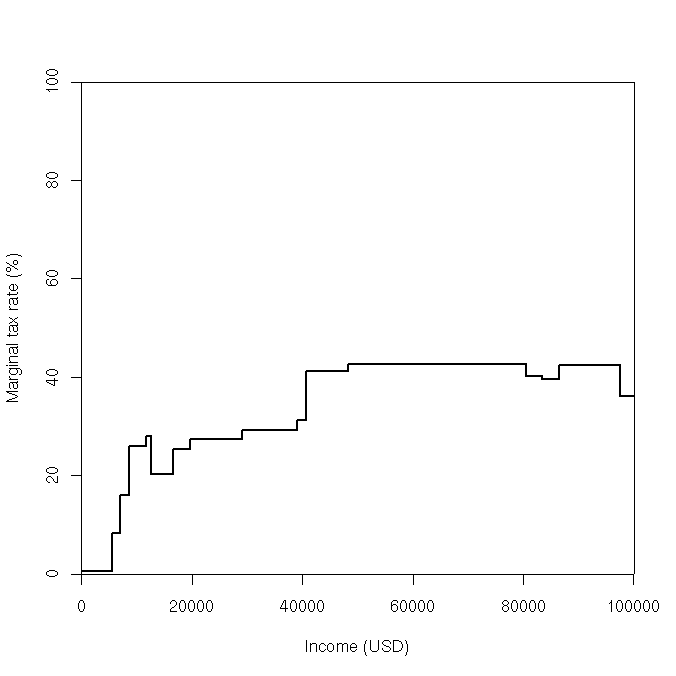

And here's a zoom of the part of the graph under $100,000:

One way to understand what this graph represents is that if a person

meeting these conditions drew a vertical line at their income, the area to

the left of that line would be everything they earned. The part below the

line drawn would be the part paid in taxes, and the part above would be

the part they keep.

[ Edit, May 12, 2010 -- The reason I called these graphs

bizarre isn't the magnitude of the numbers; they're in the range one

would expect for funding a modern government. What's bizarre about

these graphs is their shape. There is no good reason for this graph to

have lots of bumps in it. I'd expect a line that's gradually increasing

(perhaps stepwise), not one that goes up and down a lot. I think the

bumps are a result of the bad process we use for making policy. --

end Edit]

The details of these marginal rates are:

- Thanks to standard deductions and dependent exemptions (since the

taxpayer has himself as a dependent), both federal and California income

taxes don't kick in immediately. However, the Earned Income credit does

(at a rate of -7.65%), so the initial marginal rate is

0.6% when subtracting that credit from the other three

taxes. (This ignores other antipoverty programs, though.)

- Around $5550 (where the total tax paid is around $33.30),

the Earned Income Credit changes to a flat $428, bringing the marginal

rate up to the rate of Social Security plus Medicare plus California

SUI/SDI, which is 8.25%.

- Around $7000 (where the total tax is around $150), the

Earned Income Credit starts decreasing. (This is for single people; for

people with children it's still increasing (not even flat yet) at this

income level.) This brings the marginal rate up to

15.9%.

- At $8750 (where the total tax is around $428),

we've used up the federal standard deduction and 1 exemption, so federal

income taxes kick in at 10%, making the marginal rate

25.9%

- At $11629 (where the total tax is around $1174),

we've used up California's standard deduction ($3516) and the $94

after-tax exemption for supporting oneself, so California

income taxes kick in at a marginal rate of 2%, making the total marginal

rate 27.9%.

- At $12590 (where the total tax is around $1442),

the Earned Income Credit has hit 0, so the total marginal rate drops to

20.25%.

- At $16575 (where the total tax is around $2249),

the federal income tax rate goes up to 15%, so the total marginal rate

is 25.25%

- At $19701 (where the total tax is around $3038),

the California income tax rate goes up to 4%, so the total marginal rate

is 27.25%

- At $29060 (where the total tax is around $5588),

the California income tax rate goes up to 6%, so the total marginal rate

is 29.25%

- At $38976 (where the total tax is around $8489),

the California income tax rate goes up to 8%, so the total marginal rate

is 31.25%

- At $40600 (where the total tax is around $8996),

the Federal income tax rate goes up to 25%, so the total marginal rate

is 41.25%

- At $48330 (where the total tax is around $12185),

the California income tax rate goes up to 9.3% (the top bracket), so the

total marginal rate is 42.55%

- At $80460.81 (where the total tax is around

$25857), total payments of income taxes to California now equal the

federal standard deduction ($5350), so it becomes worth itemizing

deductions on federal taxes. The marginal rate for total California

taxes is 9.9%. This means that 9.9% of each additional dollar doesn't

count towards federal income tax, reducing its effective marginal rate

from 25% to 22.525%, making the total marginal rate

40.075%.

- At $83388.33 (where the total tax is around

$27030), the maximum payment into California state disability and

unemployment insurance ($500.33) is paid. This, in turn, reduces the

total marginal rate of state taxes to 9.3%, which increases the

effective federal income tax marginal rate (remember the last step) to

22.675%, making the total marginal rate 39.625%

- Around $86421.96 (where the total tax is around

$28232), the Federal income tax rate goes up to 28%. Remember we're

deducting 9.3% of income, though, so the total marginal rate is

42.346%

- At $97500 (where the total tax is around $32923),

Social Security taxes stop, so the total marginal rate is

36.146%

- At $156400 (where the total tax is around $54215),

Federal exemption and deduction limiting kicks in, the former in a

series of discrete jumps of $12.69 each (1.181333% slope), and the

latter continuously (at a 7.3% slope). Around the same point (actually

the first step is at $156666, but treating it as a continuous function

it starts at $155416), California exemptions start being limited as

well. Since this is a very small effect: a series of $4.32 steps for

every increment of $2500 in income ($6 more in California tax, minus the

offset that causes in Federal tax), I'll just throw it in here as well.

Treating all of these as continuous, this makes the total marginal rate

around this point change to approximately 37.39%.

- At an income of $177914.32 (where the total tax is

around $62258), the Federal tax rate goes up to 33%, changing the total

marginal rate to approximately 42.1%.

- At an income of $190153.08 (where the total tax is

around $67411), the alternative minimum tax kicks in (with the

alternative structure passing the regular income tax structure), and the

total marginal rate changes to 43.49%. Note that even

with small amounts of income from capital gains, this can happen at

significantly lower income, because the alternative minimum tax's steep

exemption phaseout does include capital gains (whereas almost nothing

else does).

- Around an income of $194582.66 (assuming a

continuous function, which it really isn't), the California exemption

hits zero (so the gradual limiting stops), and the marginal rate drops

to 43.25%.

- At $197980 (where the total tax is around $70807),

the alternative minimum tax rate jumps from 26% to 28% (though the

effective rate is larger, jumping here from 32.5% to 35%, since the AMT

exemption limiting is still being phased in), making the total marginal

rate now 45.75%.

- At $289900 (where the total tax is around $112860),

the AMT exemption is now limited down to zero, which makes the federal

income tax marginal rate drop to the AMT's official 28%, making the

total marginal rate now 38.75%.

- At $409665.88 (where the total tax is around

$159269), the regular federal income tax rate schedule (with its now

higher marginal rates) crosses above the alternative minimum tax again,

making the total marginal rate now 43.195%. This is

the marginal rate on income from this point up (given these very simple

assumptions).

I probably made a whole bunch of mistakes here, never mind the major

pieces I omitted, but this seesaw graph starts to paint a picture of the

US tax system. It has so many details and patches to fix little things

that the big picture is a mess.

I think I'd probably prefer a graduated (and actually progressive)

tax on consumption (allowing major purchases like houses and cars to be

treated as investments, consuming only the fair market value of the

opportunity cost of not renting it). This could be done through a

mechanism similar to the one we have now (but simpler), except where

savings are deductable and loans are taxable.

See the Haskell program that I used to

figure a bunch of this out, as well as the data and R code

that I used for the plot.

David Baron, dbaron@dbaron.org, 2008-03-17